BTC Price Prediction: Assessing Bullish Potential Amid Market Volatility

#BTC

- Technical Outlook: BTC shows bullish MACD signals but remains in consolidation.

- Institutional Demand: Large-scale purchases conflict with profit-taking before Fed meetings.

- Regulatory Tailwinds: Growing institutional adoption could offset fraud-related skepticism.

BTC Price Prediction

BTC Technical Analysis: Key Indicators to Watch

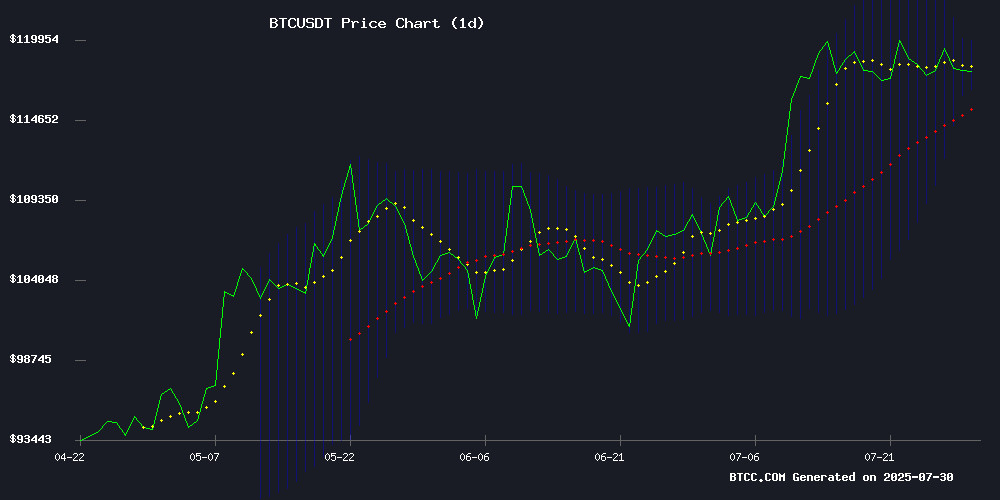

According to BTCC financial analyst John, Bitcoin (BTC) is currently trading at $118,242.40, slightly below its 20-day moving average (MA) of $118,305.43. The MACD indicator shows a bullish crossover with the histogram at 1,978.71, suggesting potential upward momentum. However, the price remains within the Bollinger Bands, with the upper band at $119,905.05 and the lower band at $116,705.81, indicating a period of consolidation. John notes that a break above the upper Bollinger Band could signal a bullish trend, while a drop below the lower band may indicate further downside.

Market Sentiment: Mixed Signals for Bitcoin

BTCC financial analyst John highlights mixed market sentiment for Bitcoin. Institutional selling has emerged ahead of the Fed meeting, potentially creating short-term headwinds. However, significant acquisitions by firms like Anchorage Digital and Strategy, totaling over $3.6 billion in BTC, underscore strong institutional confidence. John cautions that while bullish catalysts like MARA's earnings rally and expanding bitcoin adoption (e.g., mortgage eligibility proposals) exist, warnings from 10x Research about $140K resistance and fraud cases (e.g., AML Bitcoin) could temper optimism. The market appears to be balancing these opposing forces.

Factors Influencing BTC’s Price

Bitcoin Consolidates Near $120K Ahead of Fed Meeting as Institutional Selling Emerges

Bitcoin's price action has stalled below the psychologically significant $120,000 level as traders adopt caution ahead of Wednesday's Federal Reserve meeting. The cryptocurrency now trades in a tight $117,000-$120,000 range, with technical indicators suggesting an impending volatility expansion.

Long-term holders have begun distributing coins near current levels, marking the first meaningful test of Bitcoin's recent rally. Notably, Galaxy Digital's reported 80,000 BTC sale has introduced institutional selling pressure—a departure from typical retail-driven pullbacks. This activity suggests professional investors are taking profits after the asset's historic run.

Market structure shows weakening momentum, with open interest declining $1 billion and $173.8 million in long positions liquidated. Bollinger Band compression indicates shrinking volatility that typically precedes significant price movements, leaving traders anticipating the Fed's policy signals as the next potential catalyst.

AML Bitcoin Founder Sentenced to Seven Years for $10 Million Fraud

Rowland Marcus Andrade, the founder of AML Bitcoin, has been sentenced to seven years in federal prison for wire fraud and money laundering. The scheme defrauded investors of $10 million through false claims about the token's technology and fabricated business deals, including a non-existent agreement with the Panama Canal Authority.

Andrade misappropriated over $2 million for personal luxuries, including high-end vehicles and real estate. A forfeiture hearing scheduled for September 16 will determine victim restitution. The defendant's prison term begins October 31, followed by three years of supervised release.

The case also ensnared lobbyist Jack Abramoff, who faced regulatory action for promoting the fraudulent cryptocurrency venture. This sentencing underscores the increasing judicial scrutiny of misconduct in digital asset markets.

Why Bitcoin’s $140K Goal May Face Strong Headwinds, Warns 10x Research

Bitcoin's rally toward $140,000 faces significant challenges despite its strong performance this year, according to a new 10x Research report. The cryptocurrency's 6-figure price has fueled bullish sentiment, but historical patterns suggest potential turbulence ahead.

10x Research's seasonal model, which accurately predicted Bitcoin's 9.8% July gain versus a forecasted 9.1%, now signals caution. August has historically been Bitcoin's worst month, with prices dropping in 8 of the past 12 years at an average 8.6% decline. September maintains similarly bearish tendencies.

The report indicates Bitcoin may retest $100,000 support before any sustained push toward $140,000. This contrasts with current market optimism driven by political developments and institutional interest.

The Smarter Web Company Expands Bitcoin Holdings to 2,050 BTC

The Smarter Web Company has acquired an additional 225 Bitcoin, bringing its total holdings to 2,050 BTC. This strategic accumulation underscores the firm's bullish stance on Bitcoin as a long-term store of value and hedge against macroeconomic uncertainty.

Corporate treasury diversification into digital assets continues gaining momentum, with Bitcoin remaining the preferred choice for institutional adoption. The purchase reflects growing confidence in cryptocurrency's role as a portfolio diversifier amid volatile traditional markets.

Satoshi Nakamoto’s Vision of Bitcoin Comes True After 15 Years

Fifteen years after Bitcoin's enigmatic creator Satoshi Nakamoto dismissed skeptics with "I don't have time to try to convince you," the cryptocurrency has achieved global recognition as both a transactional currency and store of value. What began as an obscure cryptographic experiment now stands as the foundation of digital finance, validating Nakamoto's prescience against early doubts.

The Bitcoin network's immutable ledger and decentralized architecture have spawned an entire ecosystem of financial innovation. From institutional adoption to Layer-2 scaling solutions, Nakamoto's original whitepaper continues to influence technological and economic paradigms. Market capitalization exceeding $1 trillion confirms Bitcoin's transition from niche asset to macroeconomic force.

Anchorage Digital Acquires $1.19 Billion in Bitcoin in Nine-Hour Spree

Anchorage Digital, a federally chartered digital asset bank, has made a decisive move into Bitcoin, snapping up 10,141 BTC worth $1.19 billion across multiple wallets in under nine hours. The acquisition underscores institutional confidence in Bitcoin as a reserve asset and signals deepening involvement of regulated entities in cryptocurrency markets.

Market observers suggest the bank likely sourced the Bitcoin through over-the-counter desks to avoid price slippage. This stealth accumulation strategy reflects growing sophistication among institutional players entering the crypto space.

The transaction represents one of the largest single institutional Bitcoin purchases this year, potentially foreshadowing renewed corporate treasury demand. As traditional finance institutions like Anchorage build substantial positions, Bitcoin's role as a macro asset continues evolving beyond speculative trading.

Strategy Acquires 21,021 Bitcoin in $2.47 Billion Purchase Following Record U.S. IPO

Strategy, the Bitcoin-centric firm co-founded by Michael Saylor, has executed its largest Bitcoin acquisition of the year, securing 21,021 BTC for $2.47 billion at an average price of $117,256 per coin. The purchase was fueled by proceeds from the company's $2.5 billion Series A Perpetual Preferred Stock (STRC) offering, which became the largest U.S. IPO of 2025 after being upsized fivefold due to overwhelming demand.

The firm now holds 628,791 BTC—the largest corporate Bitcoin treasury globally—with an average acquisition cost of $73,277 per coin. Strategy's year-to-date Bitcoin yield stands at 25.0%, reflecting the asset's appreciation since its pivot from business software to Bitcoin advocacy in August 2020.

STRC shares began trading on Nasdaq today, marking the first perpetual preferred stock issuance by a Bitcoin treasury company. The instrument offers monthly board-adjusted dividends, appealing to income-focused investors while maintaining Strategy's Bitcoin accumulation strategy.

U.S. Senator Proposes Including Bitcoin in Mortgage Eligibility Criteria

U.S. Senator Cynthia Lummis has introduced the 21st Century Mortgage Act, a legislative push to incorporate cryptocurrencies—particularly Bitcoin—into mortgage eligibility assessments. The bill seeks to treat crypto assets as valid collateral in credit evaluations, marking a significant step toward mainstream financial integration.

Parallel discussions are reportedly underway in the House of Representatives, signaling growing bipartisan interest in crypto's role in traditional finance. Bitcoin's market stability and adoption momentum appear to be key drivers behind the proposal.

Banking institutions currently rely on cash and conventional securities for credit decisions. This legislation could redefine risk assessment frameworks, potentially unlocking new liquidity avenues for crypto holders. Market observers note the move aligns with accelerating institutional acceptance of digital assets.

MARA Shares Surge on Strong Q2 Earnings Fueled by Bitcoin Price Rally

Bitcoin miner Marathon Digital Holdings (MARA) saw its shares climb nearly 4% in extended trading after reporting record second-quarter revenue that surpassed analyst estimates. The company posted $238.5 million in revenue, a 64% year-over-year increase, driven primarily by Bitcoin's 50% price appreciation during the period.

Marathon mined 2,358 BTC during the quarter, a 3% sequential increase, while expanding its operational hashrate to 57.4 EH/s. The miner maintains an ambitious target of reaching 75 EH/s by year-end. With nearly 50,000 BTC on its balance sheet valued at approximately $6 billion, Marathon ranks as the second-largest public company Bitcoin holder after MicroStrategy.

Unlike passive treasury holders, Marathon actively manages its Bitcoin reserves, with about 31% of its holdings deployed in lending, collateralization, or active trading strategies. This operational approach reflects the company's evolution beyond simple Bitcoin accumulation.

INEMiner Promises High Returns in Bitcoin Cloud Mining Market

INEMiner, a cloud mining platform claiming to be the world's leading service provider, is advertising daily profits of up to $8,000 through its AI-driven mining solutions. The platform reports 1.28 million global investors and emphasizes security, flexibility, and ease of use as core advantages.

The company offers diversified mining contracts and a $100 sign-up bonus, positioning itself as a gateway to digital wealth accumulation. Its promotional materials highlight a three-step onboarding process: quick registration, contract selection, and daily profit distribution.

While the platform's claims of advanced AI algorithms and high returns may attract attention, investors should exercise due diligence given the unverified nature of such promises in the cloud mining sector.

Strategy Expands Bitcoin Holdings to 628,791 BTC Amid Market Price Decline

Strategy (Nasdaq: MSTR), the largest corporate holder of Bitcoin, has fortified its balance sheet with a $2.46 billion purchase of 21,021 BTC. The acquisition, funded through a $2.52 billion IPO of preferred stock, brings its total holdings to 628,791 coins—averaging $73,277 per Bitcoin. Chairman Michael Saylor highlighted a 25% year-to-date yield on the position.

The move underscores a broader institutional trend, with 282 corporations now collectively holding over 3.61 million BTC, per BitcoinTreasuries data. Yet Bitcoin's price continues to face headwinds despite aggressive accumulation signals. Market observers point to macroeconomic uncertainty and on-chain dynamics as competing forces in the current dip.

Is BTC a good investment?

Based on current data, Bitcoin presents both opportunities and risks. Below is a summary of key factors:

| Factor | Details | Implication |

|---|---|---|

| Technical Indicators | MACD bullish crossover, price near 20-day MA | Short-term upside potential |

| Institutional Activity | $3.6B+ BTC purchases vs. institutional selling | Long-term confidence but near-term pressure |

| Regulatory News | U.S. Senator proposing BTC for mortgages | Positive adoption signal |

| Market Warnings | 10x Research notes $140K resistance | Potential price ceiling |

John advises investors to consider Bitcoin's volatility and diversify portfolios accordingly.